Import/Export

Walworth County – Foreign Trade Zone No. 41

Walworth County is part of the US Foreign Trade Zone program. The Foreign Trade Zone (FTZ) Program was created by the U.S. Government to facilitate international trade and increase the global competitiveness of U.S.-based companies. The program, which has existed since the 1930s, continues to thrive and change to better meet the needs of American companies in the global economy.

An FTZ is an area within the United States, in or near a U.S. Customs port of entry, where foreign and domestic merchandise is considered to be outside the country, or at least, outside of U.S. Customs territory. Certain types of merchandise can be imported in a Zone without going through formal Customs entry procedures or paying import duties. Customs duties and excise taxes are due only at the time of transfer from the FTZ for U.S. consumption. If the merchandise is re-exported and never enters the U.S. commerce, then no duties or taxes are paid on those terms.

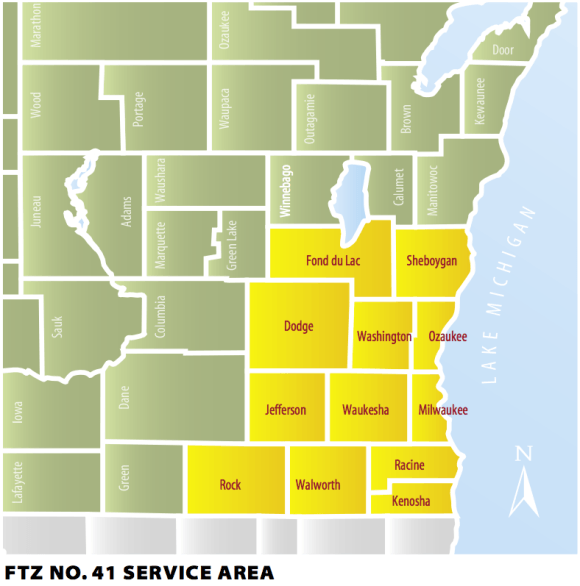

Southeastern Wisconsin Foreign Trade Zone No. 41

United States Foreign Trade Zone Board

Walworth County – Foreign Trade Zone No. 41

REDUCE THE TIME AND MONEY YOU INVEST IN LOCATING AND SCREENING PROSPECTIVE TRADE PARTNERS.

Spend your time doing what you do best — managing your company. Let the U.S. Commercial Service

arrange business meetings with pre-screened contacts representatives, distributors, professional associations,

government contacts, and/or licensing or joint venture partners.

THE GOLD KEY MATCHING SERVICES OFFER:

- Customized market and industry briefings with our trade specialists

- Timely and relevant market research

- Appointments with prospective trade partners in key industry sectors

- Post-meeting debriefing with our trade specialists and assistance in developing appropriate follow-up strategies

- Help with travel, accommodations, interpreter service, and clerical support

If your schedule or travel budget limits your ability to travel overseas, consider our Video Services. You can receive

all the benefits of our Gold Key Matching Services, but meet your potential business partners via videoconferencing

instead of in person.

To request this service, contact an Export Assistance Center near you.